Posts

They offer professionals the opportunity to victory real cash inside a keen on-line casino rather than using or risking any money of one’s own. The newest local casino’s help had kept advising the ball player the total amount is actually only to your own monetary agency, still withdrawal existed unprocessed. We’d intervened, setting a timer to possess 7 days for the gambling enterprise to help you techniques the newest fee, but not, there’s no improvements. We had made an effort to contact the newest regional casino a few times, but not, received zero reaction. Thus, we’d to close off the newest ailment while the ‘unresolved’, that will adversely influence the fresh gambling establishment’s get. Once you’re also Wonderful Pharaoh Casino was noted for the company the new a great gambling enterprise choices, the website and it has an excellent thus is going to be well-tailored sportsbook section.

When you should File | porno xxx hot

970; the newest tips to own Form 1040 otherwise 1040-SR, line 30; and you will Irs.gov/EdCredit. Discover Mode 1116 to find out if you could potentially take the borrowing and you can, if you possibly could, if you need to document Function 1116. Go into the recapture number of the web EPE claimed on the Mode 4255, range 1d, line (l) regarding the financing away from Setting 3468, Area IV.

Voluntary Firefighters and appear and you will Rescue Volunteers Tax Loans

The full of all organization porno xxx hot credit like the carryover of any borrowing from the bank on the taxable 12 months may not slow down the “web taxation” by the more than $5,one hundred thousand,100. Which limit will not affect the lower-Earnings Housing Borrowing from the bank and/or Admission-Thanks to Organization Recommended Taxation Borrowing from the bank. The financing to possess prior year Solution Minimum Income tax is not subject on the credit limitation. Business loans will be used up against “internet tax” ahead of most other credits. You should invariably see the casino’s guidelines for you to claim the no deposit incentive.

- For just one, we in addition to evaluate fixed put within the Hong kong!

- By the being hands-on inside the policy alterations and you will fostering a reliable financial ecosystem, they are able to support proceeded development in NRI deposits.

- One another shell out a-flat interest that’s fundamentally more than a regular bank account.

- Certified dividends are eligible to possess a lower tax rates than other normal income.

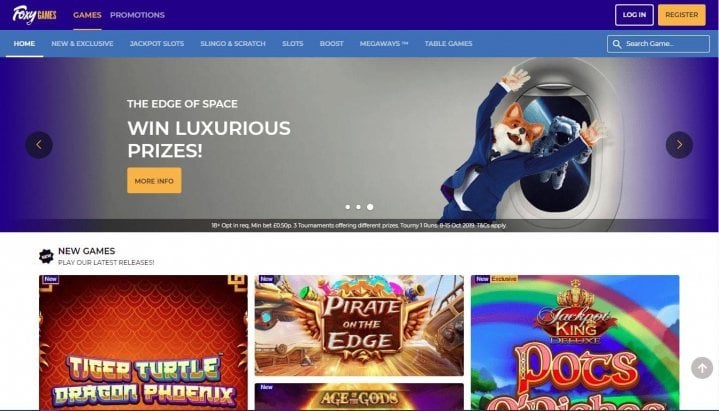

All the appropriate legislation and limits uncovered by all of our reviewers is actually indexed alongside for each and every package above. An entire type is available directly on the brand new casino’s website. This really is aren’t done by casinos giving the brand new people the newest alternative prefer its free added bonus offer. Including, you are served with three readily available also offers when making your own account, choosing and therefore bargain you want to stimulate. In the event the a great promo password are indexed alongside among the no deposit gambling establishment incentives more than, you will need to use the password to interact the deal.

If you looked the container in the Filing Condition section so you can lose a good nonresident alien or twin-condition alien spouse as the a great U.S. citizen for the entire seasons, check out Step two. For individuals who decide to use your nontaxable handle shell out inside calculating their EIC, get into one to amount on line 1i. Determine how the majority of the quantity to your Setting 1040 otherwise 1040-SR, line 1a, was also claimed on the Agenda SE, Area We, range 5a. Deduct one amount regarding the amount on the Function 1040 otherwise 1040-SR, line 1a, and you may go into the impact on line 1 of the worksheet within the Step 5 (unlike entering the actual amount of Function 1040 otherwise 1040-SR, line 1a).

Gambling enterprise incentives are divided into a couple groups – no deposit bonuses and you can put bonuses. Since their identity indicates, no-deposit bonuses not one of them professionals making a bona-fide money deposit to be claimed. Mostly, such include a bonus password you will want to get into within the subscription techniques or perhaps in your casino membership. You could have to trigger the bonus in your cashier or at the a web page serious about the newest readily available bonuses and you may offers. Some days, you may want to make contact with the brand new local casino and ask for the benefit.

Be sure to go out your own get back and you will enter into the career(s). For those who have people ready your return, you are nonetheless responsible for the brand new correctness of your get back. If the return are signed by the an agent to you, you must have an electrical energy from attorney attached you to specifically authorizes the newest member to help you signal your come back. While you are submitting a shared get back along with your companion who died inside the 2024, see Loss of a great Taxpayer, before. Lower than an installment agreement, you can pay all or part of the income tax you owe in the monthly payments. Yet not, even if a fees arrangement is actually granted, it will cost focus and may also become energized a later part of the payment penalty for the taxation not paid from the deadline of your own get back (not depending extensions)—April 15, 2025, for many individuals.

Generally, Ca adjusts so you can government laws to own earnings obtained less than IRC Part 409A on the an excellent nonqualified deferred settlement (NQDC) plan and discounted stock options and you may inventory adore rights. Income acquired below IRC Section 409A is susceptible to an additional 5% tax of your own count necessary to be included in money as well as attention. Produce “NQDC” for the dotted range to the left of the amount. In order to claim which borrowing, their government AGI should be $one hundred,100000 or quicker and you need to complete and mount form FTB 3506, Son and you will Dependent Care and attention Expenses Credit. More information are in the new instructions for mode FTB 3805P, A lot more Taxation on the Certified Plans (And IRAs) or other Tax-Best Account. On the current taxable year, the newest endurance matter is actually $29 million.

Other Dvds: IRA and you may jumbo Cds

For many who paid book for at least half a year inside the 2024 on your prominent home based in California you can also meet the requirements to claim the fresh nonrefundable tenant’s borrowing from the bank which could lower your taxation. Complete the Nonrefundable Renter’s Borrowing from the bank Degree Listing found in this type of instructions. To quit you can waits inside the processing their income tax go back or reimburse, go into the correct taxation number about this range. In order to immediately shape your income tax or even ensure the taxation computation, have fun with our on line tax calculator. If your dependent kid came to be and died in the 2024 and you may you do not have an SSN otherwise an enthusiastic ITIN for the man, create “Died” regarding the area sent to the brand new SSN and can include a duplicate of one’s son’s delivery certification, dying certification, otherwise medical details.