Blogs

See the Schedule B instructions to possess processing conditions to possess Variations 1099-DIV and you can 1096. You’re a contractor who was disabled since the a result of of doing efforts to clean within the Industry Change Heart and you are qualified to receive settlement because of the Sep eleven Sufferer Settlement Fund. Your began acquiring a handicap your retirement in the decades 55 when you you are going to not any longer works due to your impairment. Under your retirement bundle you’re permitted an early retirement advantageous asset of $2,five hundred 30 days in the many years 55. For many who hold back until decades 62, the standard retirement age beneath the bundle, would certainly be eligible to an everyday old age benefit of $step 3,one hundred thousand thirty days.

Pokie spins casino | Corporation/Partnership/Unincorporated Relationship Membership

Additionally, we might like when the Quontic didn’t features the very least put needs and you can refunded your for during the the very least specific out-of-system Atm costs. Full, the new account is actually an acceptable offer for many people. You’ll earn a substantial give on the offers, prevent of a lot costs (for example zero-charge overdrafts) and also have access to support service, and live chat.

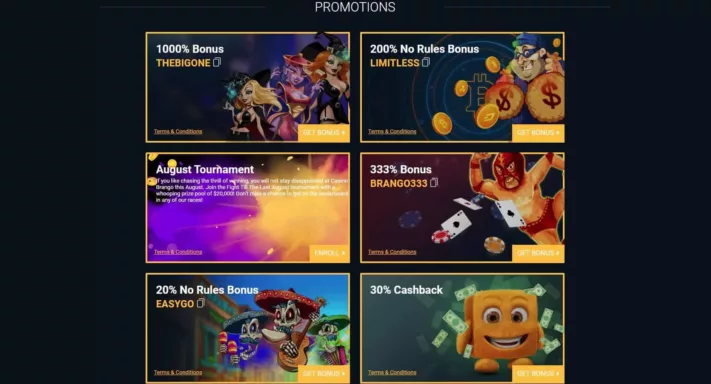

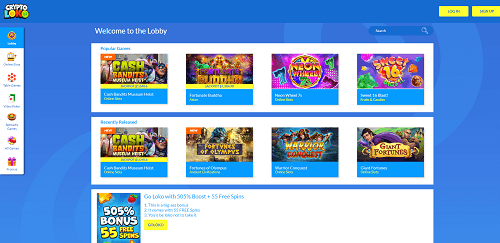

Otherwise, the brand new gambling establishment will likely confiscate the bonus and any cash your be able to earn of it. Most commonly, no deposit product sales make the type of added bonus financing to try out with or totally free revolves that can be used to your chosen slots. You could think of this type of in an effort to try another gambling enterprise as well as online game as opposed to risking your finances. Both, you ought to yourself turn on their no deposit incentive, mostly within the subscription procedure otherwise immediately after signed into your own gambling establishment account.

The most pokie spins casino borrowing from the bank allowable is restricted to $2,five-hundred for each minor man. You can even carryover the excess credit to help you future decades before the borrowing from the bank can be used. If the government AGI is over $244,857, deduct line letter from the AGI Restriction Worksheet inside range 39 tips of range 30 from Form 540NR and get into that it number on the web hands down the worksheet below in order to assess their borrowing.

“Self-directed” implies that plan professionals have the directly to direct the cash is spent, including the capacity to lead one deposits go at the an enthusiastic FDIC-insured lender. So it area refers to another FDIC control groups as well as the requirements a great depositor must see in order to qualify for insurance coverage a lot more than $250,100000 during the one to insured financial. FDIC insurance discusses places received in the an insured financial, however, will not security assets, even if these were bought at an insured financial. FDIC insurance coverage talks about depositor profile at each insured lender, dollar-for-dollar, along with prominent and people accrued focus from go out of the covered lender’s closure, to the insurance limit. Everything within this brochure is founded on the new FDIC regulations and you may laws and regulations in essence in the guide. The web sort of which pamphlet might possibly be up-to-date immediately in the event the signal transform impacting FDIC insurance are built.

Conditions and terms from real money no-deposit incentives

- Someplace else, Hamilton themselves was keen in order to eventually number an excellent work on win, as the Norris, Oscar Piastri, George Russell and you can Leclerc tend to all the provides to help you allege its earliest earnings of the year in this Latin The us.

- If perhaps an element of the shipping is a keen HFD and you also elect to exclude one to area away from money, go into the area this isn’t an HFD on line 4b unless Exemption dos applies to one region.

- In case your number you want to up from the worksheet is $18,591 or maybe more, and you have zero being qualified people with legitimate SSNs, you could potentially’t make the borrowing.

- Region II from Function 1095-C reveals if the company given your medical insurance visibility and you will, if that’s the case, information about the deal.

Have on line 25c people income tax withheld which is found on the Function 1042-S, Mode 8805, otherwise Mode 8288-A. To help with processing, install the shape to your return to allege a credit to possess the new withholding. For many who looked the container labeled “Partner itemizes to your independent come back or you have been dual-condition alien” to the Mate simple deduction range, the basic deduction try zero, even if you have been created just before January 2, 1960, or had been blind. See the box online 6c for individuals who decide to fool around with the newest swelling-sum election way for their professionals. Or no of your professionals are taxable to have 2024 and they are a swelling-share work with percentage which was to have an early on year, you happen to be in a position to slow down the taxable count on the lump-sum election.

Newest Earliest Federal Bank out of The united states Cd Prices

Develop one to particular time soon Connecticut Condition Firefighters Association subscription will include the fire business regarding the county, volunteer and you may community, from the wonderful features our participants discover. We along with promise that social will learn a lot more of our very own work to aid instruct teams and you may Connecticut’s Firefighters to the items associated with security away from flames. The brand new money obtains a lot of time-name monetary balances to own firefighters once the duration of solution.

Team Tax Board Confidentiality Observe on the Collection

How highest discounts interest levels goes is one of the incorrect question; you’re also better off inquiring, “Exactly how reduced you’ll they slide? ” That’s while the Government Set aside is carried out raising rates. Quontic Lender is actually a member of your own FDIC, and all of deposits are insured as much as the maximum restriction away from $250,100 for every depositor. The new See On the web Savings account offers a substantial step three.50% having little charge without minimal balance conditions. The newest People Accessibility Family savings is perfect for consumers which choose digital financial. Individuals who wanted a merchant account one encourages building a tight discounts habit—having less options to rapidly availability cash through a great debit card otherwise Automatic teller machine card—is generally a good fit.

Budget 2024 as well as indicates certain technical amendments to ensure the regulations meet their plan objectives. Ideas one to move existing low-domestic a property, including a workplace strengthening, to the a domestic advanced might possibly be qualified if the requirements above is actually satisfied. The fresh expidited CCA would not apply at home improvements out of established residential buildings. Yet not, the price of a different introduction to help you an existing construction manage be eligible, provided addition matches the brand new requirements a lot more than.

.png)

The newest cost a lot more than had been set on 2 Jun 2025 and therefore are subject to change any moment by Bank out of Asia. Do not file an amended Tax Return to update the fresh play with income tax before stated. If you have transform for the amount of explore income tax previously said on the new get back, get in touch with the fresh Ca Company out of Taxation and Payment Government.

If you possibly could allege a great refundable borrowing (besides the new made income credit, American possibility credit, or a lot more son tax borrowing); such as the internet advanced taxation borrowing from the bank. Provides most other payments, including an expense repaid having an ask for an expansion so you can document otherwise an excessive amount of personal protection tax withheld. Fool around with Setting 540 so you can amend your own unique otherwise previously filed California citizen tax go back.